Oracle Payments:

Oracle Payments Release 12 is a new, highly configurable product used to disburse and receive payments. It offers organizations

- · Centralized payment processing across Multiple organizations, currencies, and regions

- · Enhanced functionality to take advantage of new payment architecture

Oracle Payments is a fundamental part of the Oracle Applications architecture, and is provided with multiple products that requires support for payment processing. As the E-Business Suite’s new central payment engine, Oracle Payments processes invoice payments from Accounts Payable, bank account transfers from Oracle Cash Management, and settlements against credit cards and bank accounts from Oracle Receivables. Oracle Payments provides the infrastructure needed to connect these applications and others with third party payment systems and financial institutions. The centralization of payment processing in the Oracle Payments engine offers many benefits. Companies are able to efficiently centralize the payment process across multiple organizations, currencies, and regions. Oracle Payments enables better capital management by providing cash manager’s real-time visibility into cash inflows and outflows. Payments R12 provides a full audit trail and control through a single point of payment administration.

Setp1: Create XML Template

When you create a template, you assign it a data definition and upload your template layout files. Assigning the data definition makes the template available to the corresponding data source at run time.

Navigation: Parables -->Setup --> Payments --> Payment Administrator

General:

Name | Application | Type | Code | Data Definition | Start Date | End Date | Default Output type | Description |

Test Standard Format | Payments | RTF | Test | Oracle Payments Funds Disbursement Payment Instruction Extract 1.0 | 13-Dec-2012 |

Template File:

File | Language | Territory | Translatable |

IBYDC_STD1.rtf | English |

Apply.

Setp2: Create Payment Format:

Financial institutions, payment systems, and/or countries have specific formatting requirements for funds capture transactions, funds disbursement transactions, payment documents, and payment-related reporting. Formats are created within Oracle Payments to represent these requirements. Each format in Oracle Payments corresponds to one Oracle XML Publisher template. Oracle Payments uses Oracle XML Publisher templates to format funds capture and funds disbursement transactions according to the formatting requirements of specific financial institutions or payment document.

Code | Name | Type | Data Extract | XML Publisher Template | Attachments |

Check Payment Format | Test Check Payment Format | Disbursement Payment Instruction | Test Standard Format | None |

Apply.

Setp3: Define Payment Method

Navigation: Payable Manager -->Setup --> Payments --> Payment Administrator

General Tab:

Code | Name | Description | Format value Mapping | Anticipated Distribution Float |

Test | Test Payment Method | Payment Method |

Bills Payables:

Next,Next,Finsh.

Apply.

Define Reorder Priority:

Apply.

Assign Pay group:

Click on Invoice Management tab

Click on Apply.

Click on Apply.

Payment Attribute tab:

Process Automation Tab:

Validation Failure Results Tab:

Additional Information Tab:

Click on Apply.

Click on Submit.

Ofter clicked on submit the following two programs are running automatically.

A)Auto Select (Payment Process Request Program)

B)Scheduled Payment Selection Report

Ofter submit the single request the Payment Process Request status is Invoices Pending Review

Click on Start Action.

Ofter clicking the submit button the status is Calculating Special Amounts

ofter submit the PPR the following 3 programs are running

A)Apply Changes, Recalculate Amounts and Submit Request (Recalculate Payment Process Request)

B)Scheduled Payment Selection Report

C)Build Payments

Ofter completing the above 3 programs the PPR Status is Pending Proposed Payment Review

Click on Start action.

Click on Go.

Once click on the go button the following programs are running

A)Build Payments

B)Format Payment Instructions

once the two programs are completed the PPR status is Confirmed Payment

Bills Payables:

Use Payment Method to Issue Bill Payables | Maturity Days |

Next,Next,Finsh.

Setp4: Define Payment Method Defaulting Rule

Navigation: Payable Manager -->Setup --> Payments --> Payment Administrator

Create:

Product | Payment Method | Rule Name |

Oracle Payables | Test Payment Method | Test Rule |

Apply.

Define Reorder Priority:

Navigation: Payable Manager -->Setup --> Payments --> Payment Administrator

Apply.

Setp5: Define Pay group:

Navigation: Setup --> Setup --> Lookups --> Purchasing

Type | Meaning | Application | Description | Access Level User Extensible System | ||

PAY GROUP | Valid pay groups | Purchasing | Valid pay groups | Yes | No | No |

Code | Meaning | Description | Tag | Effective Date From | Effective Date To | Enabled |

SUPPLIER GROUP | SUPPLIER GROUP | SUPPLIER GROUP | 13-Dec-2012 | yes |

Setp6: Assign Pay group and Payment Method to Suppliers header and site level:

Navigation: Supplier --> Entry

query your supplier

click on update

Payment Details Tab:

Payment Method | Default | End Date |

Test Payment Method | Yes |

Assign Pay group:

Click on Invoice Management tab

Setp6: Define Payment Document:

Setup --> Payment --> Bank Accounts

query your bank account and then click on Manage payment document.

Click on Create

Document Information:

Name | Paper Stock Type | Number of Setup Documents | Format | Payment Document Category |

Test payment Document | Blank Stock | Test Check Payment Format |

Document Numbers:

First Available Number | Last Available Number |

1 |

Click on Apply.

Setp7: Define PPP

Navigation: Payable Manager --> Setup --> Payment --> Payment administrator

Click on Payment process profile Go To Task

Click on create

Code | Name | Description | Process Type | Default Payment Document | Payment File | Default Printer | Payment System | Transmission Configuration |

Test | Test PPP | Payments Process Profile | Printed | Test Payment Document | Send to Printer |

Usage Rules:

Payment Method | Currencies | First Party Organization |

Test Payment Method | All |

Click on Apply.

Setp8: Define Template

Navigation: Payable Manager --> Payment --> Entry --> Payment Manager

Click on Template and then click on create.

Name | Description | User | Template Type | End Date |

Test Template | Template | USER Name |

Scheduled Payment Selection Criteria Tab:

Number of Pay From Days | Additional Pay Through Days | Payment Priority High | Payment Priority Low | Supplier Type | Payee | Payment Method | Document Exchange Rate Type |

0 | 1 | 99 |

Pay Group | Legal Entities | Payment Currencies | Operating Unit |

All | All | All | All |

Payment Attribute tab:

Payment Date | Disbursement Bank Account | Payment Document | Payment Process Profile | Payment Exchange Rate Type | Override Settlement Priority | Override Bank Charge Bearer | Transfer Priority | Starting Voucher Number |

Same as Request Date | Test Account | Test Payment Document | Test PPP | corporate |

Process Automation Tab:

Maximize Credits | Stop Process for Review After Schedule Payment Selection | Calculate Payment Withholding and Interest During Scheduled Payment Selection | Stop Process for Review After Creation of Proposed Payments | Create payment Instructions |

No | Yes | Yes | Yes | Initiate when Payment Process Request is Completed |

Validation Failure Results Tab:

Document | Payment |

Reject All Document for Payee When any Document Fail | Reject Only Payment With Error |

Additional Information Tab:

Click on Apply.

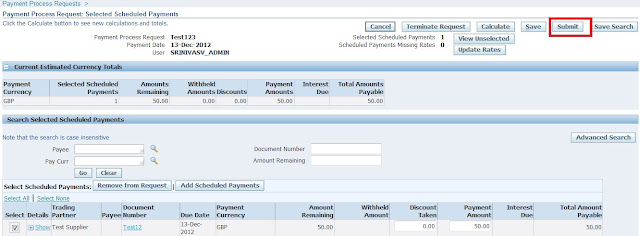

Run Payment Process Request Template:

Click on submit single request.

Payment Process Request Name | User Template |

Test PPR | Test PPT |

Click on Submit.

Ofter clicked on submit the following two programs are running automatically.

A)Auto Select (Payment Process Request Program)

B)Scheduled Payment Selection Report

Ofter submit the single request the Payment Process Request status is Invoices Pending Review

Click on Start Action.

Ofter clicking the submit button the status is Calculating Special Amounts

ofter submit the PPR the following 3 programs are running

A)Apply Changes, Recalculate Amounts and Submit Request (Recalculate Payment Process Request)

B)Scheduled Payment Selection Report

C)Build Payments

Ofter completing the above 3 programs the PPR Status is Pending Proposed Payment Review

Click on Start action.

Click on Go.

Once click on the go button the following programs are running

A)Build Payments

B)Format Payment Instructions

once the two programs are completed the PPR status is Confirmed Payment